Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Monday, July 13, 2009

Nice rally back up to test Head-and-Shoulders Top Neckline.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Tuesday, July 7, 2009

Will most likely exit today.

Monday, July 6, 2009

Testing Head-and-Shoulders Top (HST) neckline.

The SPX is trying to confirm a rather large Head-and-Shoulders Top (HST) by closing below the neckline (NL). If the HST is confirmed I'll expect a drop to at least 825 (HST-OBJ) which isn't something that I'm willing to ride out. Therefore today, if the SPX is at or below 887 (which is today's early low) at my fund cutoff time (~10 min before the close), I'll exit to 100% cash with my accounts not managed by mechanical methods.

The SPX is trying to confirm a rather large Head-and-Shoulders Top (HST) by closing below the neckline (NL). If the HST is confirmed I'll expect a drop to at least 825 (HST-OBJ) which isn't something that I'm willing to ride out. Therefore today, if the SPX is at or below 887 (which is today's early low) at my fund cutoff time (~10 min before the close), I'll exit to 100% cash with my accounts not managed by mechanical methods.

I do have quite a bit of hope for a reversal today back above NL and thus no confirmed HST. We have two unfilled gaps overhead (G1, G2) which should tend to resist further downside. We had a late-day sell off before the holiday that took out extremely minor support at the level of the expected downside objective from the 7/2/09 open which gapped down and out of an uptrending channel. (Channel break downside objective = CH-OBJ). Then we opened gap down this morning.

---

Right now (11:45am Mountain), the SPX is trying to move higher to fill the gap G1. If this happens too early in the day (like now), we could get some selling which would move the SPX down to lows at the close. The action near the close today is going to be very interesting. If buying can come in late to close G1 and the day closes up to near today's highs, I'll expect more upside to fill G2 at over 920.

---

On the other hand, if we close down near today's low, I think the HST will be considered confirmed and we should move lower to at least 825 eventually. I won't necessarily expect the drop to occur immediately and there may be another move back up to NL which will be an obvious exit point if we miss this one.

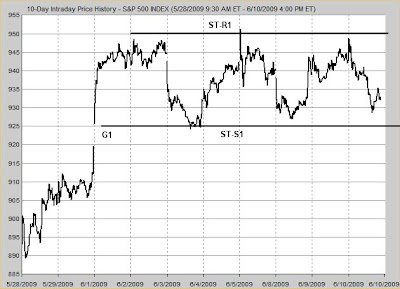

Wednesday, June 10, 2009

SPX consolidation

Monday, June 1, 2009

Another Head-and-Shoulders Bottom (HSB) Confirmed.

Tuesday, May 26, 2009

Good rally without an opening gap.

The SPX has rallied well today off NL for the second retest of the Head-and-Shoulders Bottom (HSB) Neckline.

The SPX has rallied well today off NL for the second retest of the Head-and-Shoulders Bottom (HSB) Neckline.

Wednesday, May 20, 2009

I'll give this position some room.