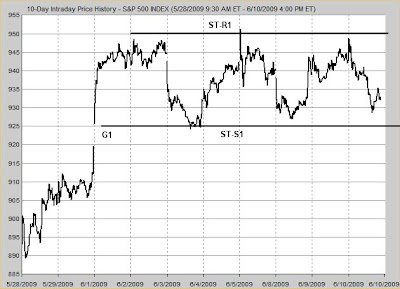

As I said last time I expected the SPX to move sideways for about a month and we're now eight days into it. The gap (G1) still has not yet filled and it probably will. ST-S1 is roughly the confirmed Head-and-shoulders Neckline (NL2) which has now been tested approximately three times. My current plans are to just sit tight hoping to sell at SPX 1000 or higher but that could change if we are near ST-R1 (950) at a market close I might be tempted to exit and buy back in on any lower close inside this little trading range.