Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Monday, July 13, 2009

Nice rally back up to test Head-and-Shoulders Top Neckline.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Today's SPX rally is a textbook retest of the Head-and-Shoulders Top (HST) Neckline (NL). The minimum objective of the HST is down to around 825 (HST-OBJ). We also have a downtrend line (R1) appearing to form.

Tuesday, July 7, 2009

Will most likely exit today.

Monday, July 6, 2009

Testing Head-and-Shoulders Top (HST) neckline.

The SPX is trying to confirm a rather large Head-and-Shoulders Top (HST) by closing below the neckline (NL). If the HST is confirmed I'll expect a drop to at least 825 (HST-OBJ) which isn't something that I'm willing to ride out. Therefore today, if the SPX is at or below 887 (which is today's early low) at my fund cutoff time (~10 min before the close), I'll exit to 100% cash with my accounts not managed by mechanical methods.

The SPX is trying to confirm a rather large Head-and-Shoulders Top (HST) by closing below the neckline (NL). If the HST is confirmed I'll expect a drop to at least 825 (HST-OBJ) which isn't something that I'm willing to ride out. Therefore today, if the SPX is at or below 887 (which is today's early low) at my fund cutoff time (~10 min before the close), I'll exit to 100% cash with my accounts not managed by mechanical methods.

I do have quite a bit of hope for a reversal today back above NL and thus no confirmed HST. We have two unfilled gaps overhead (G1, G2) which should tend to resist further downside. We had a late-day sell off before the holiday that took out extremely minor support at the level of the expected downside objective from the 7/2/09 open which gapped down and out of an uptrending channel. (Channel break downside objective = CH-OBJ). Then we opened gap down this morning.

---

Right now (11:45am Mountain), the SPX is trying to move higher to fill the gap G1. If this happens too early in the day (like now), we could get some selling which would move the SPX down to lows at the close. The action near the close today is going to be very interesting. If buying can come in late to close G1 and the day closes up to near today's highs, I'll expect more upside to fill G2 at over 920.

---

On the other hand, if we close down near today's low, I think the HST will be considered confirmed and we should move lower to at least 825 eventually. I won't necessarily expect the drop to occur immediately and there may be another move back up to NL which will be an obvious exit point if we miss this one.

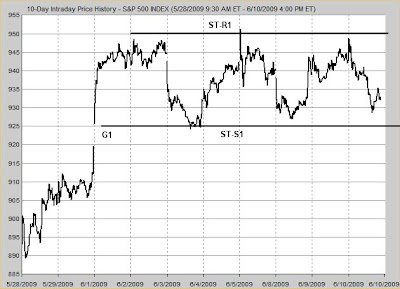

Wednesday, June 10, 2009

SPX consolidation

Monday, June 1, 2009

Another Head-and-Shoulders Bottom (HSB) Confirmed.

Tuesday, May 26, 2009

Good rally without an opening gap.

The SPX has rallied well today off NL for the second retest of the Head-and-Shoulders Bottom (HSB) Neckline.

The SPX has rallied well today off NL for the second retest of the Head-and-Shoulders Bottom (HSB) Neckline.

Wednesday, May 20, 2009

I'll give this position some room.

Wednesday, May 13, 2009

Almost down to the 875 retest.

A Head-and-Shoulders Top (HST) has formed in the intraday chart that implies a drop to O1 at 865. The neckline (NL) of the Head-and-shoulders Bottom (HSB) in the daily chart, that I've been expected the SPX to retest is at 875. We also have an unfilled gap just above G3. Some buying should come in just under 880 from those trying to accumulate as they expect G3 to fill and they want to be sure to position long so they put orders in just above G3.

A Head-and-Shoulders Top (HST) has formed in the intraday chart that implies a drop to O1 at 865. The neckline (NL) of the Head-and-shoulders Bottom (HSB) in the daily chart, that I've been expected the SPX to retest is at 875. We also have an unfilled gap just above G3. Some buying should come in just under 880 from those trying to accumulate as they expect G3 to fill and they want to be sure to position long so they put orders in just above G3.

As you can see in the chart above, we're very close to the retest of NL. There may be more downside but today's close could be the lowest in this retest move. The line that I've wanted to buy at for the last month is S1 above which is at about 855 today. We still may test S1 in the future but I think S1 is about the lower limit on any downside in this current move.

As you can see in the chart above, we're very close to the retest of NL. There may be more downside but today's close could be the lowest in this retest move. The line that I've wanted to buy at for the last month is S1 above which is at about 855 today. We still may test S1 in the future but I think S1 is about the lower limit on any downside in this current move.

Tuesday, May 12, 2009

Channel Failure

The SPX fell out of the ST-S1/ST-R1 channel today which implies a drop of the channel's width down to O2. The late day strength we're seeing now appears to be a perfect retest of ST-S1. In my opinion, the channel failure makes it more likely that we'll soon see a retest of NL and a fill of the 05/04/09 opening gap. I'm still waiting for that retest before I enter long positions with my accounts not controlled by mechanical methods.

The SPX fell out of the ST-S1/ST-R1 channel today which implies a drop of the channel's width down to O2. The late day strength we're seeing now appears to be a perfect retest of ST-S1. In my opinion, the channel failure makes it more likely that we'll soon see a retest of NL and a fill of the 05/04/09 opening gap. I'm still waiting for that retest before I enter long positions with my accounts not controlled by mechanical methods.

Monday, May 11, 2009

Gap open down Today.

The SPX gapped down today and almost filled the G2 gap but plenty of buyers at the gap stopped the drop quickly. The SPX has been trending up slightly ever since. This uptrend has set up a support line parallel but above ST-S1. This and the recent action with the SPX near to, and slightly above ST-R1 at the channels high boundary indicates that the SPX is having trouble getting anything really going on the downside. This is what one would expect in a market that should move much higher.

The SPX gapped down today and almost filled the G2 gap but plenty of buyers at the gap stopped the drop quickly. The SPX has been trending up slightly ever since. This uptrend has set up a support line parallel but above ST-S1. This and the recent action with the SPX near to, and slightly above ST-R1 at the channels high boundary indicates that the SPX is having trouble getting anything really going on the downside. This is what one would expect in a market that should move much higher. Thursday, May 7, 2009

SPX Correcting.

Wednesday, May 6, 2009

SPX Strong and should move higher.

Tuesday, May 5, 2009

Retesting.

Monday, May 4, 2009

Thursday, April 30, 2009

Looks line another failed attempt at breaking NL?

The SPX gapped above NL? and traded above it for much of the day but has now fallen back below. The SPX has also formed a small Head-and-Shoulder Top (HST) today that was confirmed by dropping below the neckline ST-NL. This HST implies a drop to 855 which would also fill the G1 gap. But by doing that the ST-S2/ST-R2 channel would fail implying a further drop to 835 which is on ST-S1.

The SPX gapped above NL? and traded above it for much of the day but has now fallen back below. The SPX has also formed a small Head-and-Shoulder Top (HST) today that was confirmed by dropping below the neckline ST-NL. This HST implies a drop to 855 which would also fill the G1 gap. But by doing that the ST-S2/ST-R2 channel would fail implying a further drop to 835 which is on ST-S1.

Wednesday, April 29, 2009

SPX at Important Resistance. Can it break out?

Tuesday, April 28, 2009

Still Moving Sideways

As I expected the SPX has been moving sideways now for a few days. A failed attempt at breaking above NL? was made near Friday's close.

As I expected the SPX has been moving sideways now for a few days. A failed attempt at breaking above NL? was made near Friday's close.

Friday, April 24, 2009

Interesting action today, still being patient.

Thursday, April 23, 2009

Still Waiting.

I still believe that the SPX is going to move sideways for ~10 days as it replicates the action in C1. This sideways move should be bound by NL? and ST-S1. If the SPX can tag ST-S1, I think a sufficient right shoulder will have formed to argue that a Head-and-shoulders Bottom (HSB) pattern will be confirmed with a break above NL?. This is the scenario that I'm currently operating under and therefore I'm looking to go 100% long with my accounts not managed by mechanical methods.

I still believe that the SPX is going to move sideways for ~10 days as it replicates the action in C1. This sideways move should be bound by NL? and ST-S1. If the SPX can tag ST-S1, I think a sufficient right shoulder will have formed to argue that a Head-and-shoulders Bottom (HSB) pattern will be confirmed with a break above NL?. This is the scenario that I'm currently operating under and therefore I'm looking to go 100% long with my accounts not managed by mechanical methods.

Monday, April 20, 2009

False Breakout but it's not over yet.

Friday's close was obviously above R1 (chart below) which did constitute a breakout above R1. However, that break was obviously false. I don't think the false break really means anything other than the SPX just wasn't ready to move higher yet.

Friday's close was obviously above R1 (chart below) which did constitute a breakout above R1. However, that break was obviously false. I don't think the false break really means anything other than the SPX just wasn't ready to move higher yet.

Friday, April 17, 2009

Trading above R1 again today.

Thursday, April 16, 2009

Trading above R1

At 1:25pm (Mountain), the SPX at 869 appears to be trading above R1. In my opinion, a close above 872 or so will be a pretty clear break of R1. Since we're so close, it's going to be impossible to know at my fund cutoff time whether the close today will be a breakout and therefore I will not assume so and will not take a long position today. Selling could still easily come in near the close and take the SPX clearly back below R1.

At 1:25pm (Mountain), the SPX at 869 appears to be trading above R1. In my opinion, a close above 872 or so will be a pretty clear break of R1. Since we're so close, it's going to be impossible to know at my fund cutoff time whether the close today will be a breakout and therefore I will not assume so and will not take a long position today. Selling could still easily come in near the close and take the SPX clearly back below R1.

Tuesday, April 14, 2009

SPX rejected at R1 once...

The SPX gapped open down today,

The SPX gapped open down today,

Now that R1 has obviously pushed the SPX down,

Now that R1 has obviously pushed the SPX down, Monday, April 13, 2009

Testing Resistance R1

The SPX is testing the important downtrending resistance line R1 (chart below) right now as we near the close. On a shorter term basis a line of support has formed ST-S1. If R1 turns the SPX lower here, an uptrending channel will form with the upper bound being ST-R1.

I do believe that the SPX will eventually break out above R1 but I will not be buying today in any case as I'd rather be patient, wait for the break and buy the first signficant pull-back.

The SPX is testing the important downtrending resistance line R1 (chart below) right now as we near the close. On a shorter term basis a line of support has formed ST-S1. If R1 turns the SPX lower here, an uptrending channel will form with the upper bound being ST-R1.

I do believe that the SPX will eventually break out above R1 but I will not be buying today in any case as I'd rather be patient, wait for the break and buy the first signficant pull-back.

Friday, April 10, 2009

Missed opportunity...

Thursday, April 9, 2009

SPX Nearing Primary Resistance

Back to Current Reality.

At yesterday's close we rallied all the way back up to ST-R1. Whether that was based on funds forced to take positions or something more sinister such as news leaks about Wells Fargo or simply some collusion among major players, I do not know. But if anybody had any doubt about the importance of ST-R1, that doubt should be gone considering today's opening action. Sure, the opinion that today's opening move was based on the Wells Fargo news is valid and the opinion that the gap over ST-R1 is coincidence is possible. But this stuff repeats so often. Once you start watching it closely, as I've done now for 20 years, I think the "coincidence" opinion is just plain ignorant. (Sorry to be so blunt...)

My plan

As I said, I'm looking to go long. I think today's opening gap will fill before R1 is overtaken to the upside. It appears to me that ST-S3 is still the logical place for which to hope for a good buying opportunity. There should be buyers at the top of the gap, around 828-830 which should provide a bounce. But I will wait for another test of ST-S3. Since ST-S3 is upsloping that test may happen at 828-830 depending on how long it takes for the SPX to drop back to that level.

If I'm Wrong,

and the SPX breaks out above R1 before testing ST-S3 it will likely be a very dramatic move based on news. This move will almost certainly start with an opening gap which will make it likely that the SPX will drop back down to R1 in a retest at which point I'll enter my long positions.

Once I take my Positions,

there's a good chance that I'll be moving to more of an intermediate-term approach and give these positions some room to oscillate in hopes of getting most of the move up to R2. But I'll certainly switch back to more of a trading mode in early September, if not earlier due to seasonality.

This switch in trading term,

will not effect my writing in this space. I've committed to writing multiple times each week here and I'll be expanding my coverage significantly as well. I hope to continue writing almost daily forever as I really enjoy it. And I think I've figured out how to keep my time overhead low enough so that writing here will remain feasible.

Wednesday, April 8, 2009

Yeah, forget about all that...

SPX Threatening Short-Term Breakout

Tuesday, April 7, 2009

Remaining patient

Two opening down gaps in a row.

Monday, April 6, 2009

Nearing the Moment of Truth

In the intraday chart we had some very interesting action at yesterday's close and today's open. As you can see in the chart above, a well defined downtrending channel had formed. In the closing minutes the SPX broke out of that channel. That implies some really felt like there was going to be an upside surprise today. Unfortunately, that breakout was false and the SPX dropped back today to the bottom of the channel. Today's open also gapped down.

Between two gaps.

So we're now trading between two unfilled gaps which may set up an interesting opportunity. If the channel fails, I'll expect a drop equal to the width of the channel down to around 805. Another possibility is that the SPX just rides the channel down in the next few days, eventually getting down to below 815. In either of those cases, I plan on entering the market long hoping for a pop higher to fill the overhead gap at 840. Entering at 815 and selling at 840 is about a 4.5% profit in Rydex Nova which would be my main goal. My secondary goal would be to luck out and be long as some event based surprise launches the market through R1. With the restrictions that come with end-of-day trading some luck may be required to pull it off within the restrictions I'm under with this space. Honestly, I may have to play this one mostly with options, which is beyond the scope of what I can detail here. (You think trading markets is hard? Try doing it while at the same time telling others your plans in advance...) In any case, with 26 minutes left it's unlikely anything will happen today. But I'll definitely indicate any end-of-day actions I plan to take in the coming days.

Friday, April 3, 2009

SPX Turned Back by Short-Term Resistance

The SPX opened yesterday with a gap and ran to R5 where it was promptly turned back lower. As you can see above, the support line S6 which is drawn off the first significant pull back after the explosive phase of the rally, failed to support the SPX much at all. Interestingly, S6 was failing at the exact time President Obama was heralding the G20 Summit reforms as, "turning point" in the world's quest for recovery. All important turning points start with very minor technical failures. I don't think it's likely but it would not surprise me one bit if the "turning point" actually ends up being the end of this intermediate-term upmove. I'm not saying any thing negative about our President or any of the world leaders, this is just how the market often works.

In the short-term,

yesterday's opening gap will put pressure on the SPX to drop back down to fill the gap. As the gap opened it jumped through a minor line of resistance (S7) which should now act as support as the SPX comes down. Normally S7 wouldn't even be worth mentioning but any time a market gaps over something it becomes more important.

The gap also created

a little Island Reversal pattern which is an area of pricing separated on both ends by gaps at similar levels. That pattern implied a move higher equal to the height of the pattern but that happened immediately upon yesterday's open. While interesting, Islands are of minor importance in the SPX chart.

In Summary,

I think probability has the SPX eventually dropping down to S7 but not quite filling the gap. The failure to fill will be due to lots of buyers in and at the high side of the gap. Those buyers should launch another run up to attempt to break out of the important R1 (in charts below) which is now only about 25 points overhead. A break above R1 would be a very bullish indication and I think the SPX is going to make multiple attempts at a break. It's going to be interesting to watch how the SPX acts as it attempts those breakouts. For now I plan to wait on the sidelines and just watch the show.

The SPX opened yesterday with a gap and ran to R5 where it was promptly turned back lower. As you can see above, the support line S6 which is drawn off the first significant pull back after the explosive phase of the rally, failed to support the SPX much at all. Interestingly, S6 was failing at the exact time President Obama was heralding the G20 Summit reforms as, "turning point" in the world's quest for recovery. All important turning points start with very minor technical failures. I don't think it's likely but it would not surprise me one bit if the "turning point" actually ends up being the end of this intermediate-term upmove. I'm not saying any thing negative about our President or any of the world leaders, this is just how the market often works.

In the short-term,

yesterday's opening gap will put pressure on the SPX to drop back down to fill the gap. As the gap opened it jumped through a minor line of resistance (S7) which should now act as support as the SPX comes down. Normally S7 wouldn't even be worth mentioning but any time a market gaps over something it becomes more important.

The gap also created

a little Island Reversal pattern which is an area of pricing separated on both ends by gaps at similar levels. That pattern implied a move higher equal to the height of the pattern but that happened immediately upon yesterday's open. While interesting, Islands are of minor importance in the SPX chart.

In Summary,

I think probability has the SPX eventually dropping down to S7 but not quite filling the gap. The failure to fill will be due to lots of buyers in and at the high side of the gap. Those buyers should launch another run up to attempt to break out of the important R1 (in charts below) which is now only about 25 points overhead. A break above R1 would be a very bullish indication and I think the SPX is going to make multiple attempts at a break. It's going to be interesting to watch how the SPX acts as it attempts those breakouts. For now I plan to wait on the sidelines and just watch the show.

Tuesday, March 31, 2009

Back to cash.

Monday, March 30, 2009

Nothing Bearish About Today's SPX Drop yet.

Today we opened

with a big downside gap in the SPX due to news over the weekend concerning President Obama and GM/Chrysler. To me, a news-based gap and subsequent drop feels like a bit of mini-panic.

Technically speaking,

it's just a retest of the break above the R2 downtrend line, which is very common and nothing for the Bulls really be concerned about. The drop should find some support on R2 as old resistance often provides support but there's nothing all that comforting with "support" that's dropping as fast as R2. In other words, the SPX could drop day-after-day riding R2 lower and still be "supported".

Additional support,

should be provided by S3 at ~765, but its very short-term in nature. S3 is the level of an old top in the prior move down. Old tops often provide support for markets temporarily correcting down in an uptrend. S3 was also confirmed by supporting a drop on 3/20/09.

And then there's the gap.

That opening gap will tend to pull the SPX back up as long as traders don't completely give up on this rally. We're currently trading at 781 while the bottom of the gap is at 809 which is 3.6% overhead.

Lastly,

The SPX has an historical upward bias on the last day of each month and the first three trading days of the next month. For the March case, the SPX has shown a gain since 1942 over those four days 60% of the time (slighty more than normal) with the SPX appreciating at an annual rate +2.5 times normal. Since 2002, this bias has been strong with no losers, one break even, and the SPX appreciating at a 106% annual rate.

Therefore, I will take this short-term trade

with accounts not managed by mechanical accounts. As long as the SPX is between 765-790 at my Rydex cut-off time today, I'll go 100% long and sell at the first day that either today's opening gap partially or fully fills and I have a profit at the close, or at the close on the third trading day of april. However, I may change that sell plan and will make notification in this space.

Today we opened

with a big downside gap in the SPX due to news over the weekend concerning President Obama and GM/Chrysler. To me, a news-based gap and subsequent drop feels like a bit of mini-panic.

Technically speaking,

it's just a retest of the break above the R2 downtrend line, which is very common and nothing for the Bulls really be concerned about. The drop should find some support on R2 as old resistance often provides support but there's nothing all that comforting with "support" that's dropping as fast as R2. In other words, the SPX could drop day-after-day riding R2 lower and still be "supported".

Additional support,

should be provided by S3 at ~765, but its very short-term in nature. S3 is the level of an old top in the prior move down. Old tops often provide support for markets temporarily correcting down in an uptrend. S3 was also confirmed by supporting a drop on 3/20/09.

And then there's the gap.

That opening gap will tend to pull the SPX back up as long as traders don't completely give up on this rally. We're currently trading at 781 while the bottom of the gap is at 809 which is 3.6% overhead.

Lastly,

The SPX has an historical upward bias on the last day of each month and the first three trading days of the next month. For the March case, the SPX has shown a gain since 1942 over those four days 60% of the time (slighty more than normal) with the SPX appreciating at an annual rate +2.5 times normal. Since 2002, this bias has been strong with no losers, one break even, and the SPX appreciating at a 106% annual rate.

Therefore, I will take this short-term trade

with accounts not managed by mechanical accounts. As long as the SPX is between 765-790 at my Rydex cut-off time today, I'll go 100% long and sell at the first day that either today's opening gap partially or fully fills and I have a profit at the close, or at the close on the third trading day of april. However, I may change that sell plan and will make notification in this space.

Thursday, March 26, 2009

The SPX broke out above R2

which I think will launch the SPX to R1 at about 880. That's 5.7% above where we closed today. If the SPX moves straight up to R1, I will miss the ride with my accounts not managed by mechanical methods. I'll assume that the downtrending channel bound by R1/S1 is going to control this market until it doesn't, which means to me that this is still a bear market rally. Therefore, I should err on the side of caution.

Look at the chart above and assume

that I chased the market and bought in at 850 tomorrow. Then imagine R1 turning the market down all the way to S1. Well, that entry at 850 would look awfully foolish in hindsight considering how close it is to R1 in an ongoing bear market. Technical analysis is easy in hindsight so I think considering how hindsight will appear if things don't go as planned is a useful exercise.

What I'd like to see is

the SPX run to 880 (R1) in the next week or so and then about a month of consolidation with the SPX bouncing between R1 and R2. To me that would indicate the sellers just cannot push the market back down to S1. And more points on R1 in either direction make R1 more significant and the channel's influence more likely. S1 is also strengthened simply because it's a parallel counterpart to the well-defined R1. I'd hope to get some directional clues during that consolidation period and position long depending on those clues.

Then I'd like to see the SPX

blast above R1 to about 950, then correct back to R1 in a retest and very obvious buying opportunity at about 850. If that were all to occur, I'd expect the SPX to run to over 1100, which is a move similar to the width of the R1/S1 channel. This move could still just be a bear market rally but as the market moves higher, long-term investor opinion shifts to bull market "buy the dips" mode. Then the old highs (~1550) will start pulling the market higher as opinion becomes that "surely" this new bull market will make all-time highs.

Of course scenarios rarely

play out exactly as for what you wish. So as of now, I'm simply willing to miss out on the move to 880 and buy the pull back which could drop as low as 800. If I don't get that, I'll just have to wait for a post R1 breakout retest of R1 up higher. If I don't get that, I'll face what I believe to be the toughest decision that exists in market timing. When do you give up on a pull back and chase the market?

I've faced it many times before,

which reminds me that I need to revisit the historical significance of when indexes move X% above their Y-day moving averages. I believe with today's close the Dow Jones Industrial Average will be about 9% above its 21-day moving average. This is rare historically and implies great strength. Maybe the type of strength worth chasing. But considering recent volatility, measures like this compared to historical norms may also be temporarily meaningless. Or maybe I can get something interesting to reveal if I normalize with the VIX. Just thinking out loud... I will do some testing, form an opinion, and report back.